Introduction

How strategically important are Medicare Set-Aside (MSA) arrangements for the structured settlement market – and what is the current size and the future potential of this structured settlement submarket?

Historically, the exact size of the structured settlement MSA market has been impossible to measure and difficult to estimate. The structured settlement industry reports annuity premium production on a quarterly basis including total premium, total cases and average case size.

These industry reports, however, do not separately show how much premium and how many cases, are attributable to MSAs, Workers Compensation (WC) MSAs, and/or liability MSAs.

For the first time, in October 2022, the Centers for Medicare & Medicaid Services (CMS), the federal agency responsible for enforcing the Medicare Secondary Payer (MSP) Act rules, published WCMSA Statistics – but only for Fiscal Years 2020-2022.

Also in October 2022, CMS withdrew without comment a Notice of Proposed Rulemaking [NPRM] which would have clarified “existing Medicare Secondary Payer (MSP) obligations associated with future medical items related to liability insurance (including self-insurance), no fault insurance, and workers’ compensation settlements, judgments, awards, or other payments.”

For the structured settlement market, these two CMS actions (published WCMSA statistics and NPRM withdrawal) represent strategically important and related MSA developments that should induce more in depth and comprehensive analysis of both the opportunities and risks MSAs offer.

Independent Life’s MSA Series

Two prior articles in this 4-part Independent Life MSA series, (Part 1) and (Part 2), provided an overview of structured settlement WCMSA history and industry developments as well as a structured settlement perspective of the CMS WCMSA Reference Guide. Part 3 analyzed the possible reasons for the CMS NPRM withdrawal and offered suggested alternatives for settlement professionals in future liability cases.

This final Part 4 article utilizes the recently published CMS WCMSA statistics to estimate the impact of WCMSAs on the current structured settlement market. Considering those WCMSA statistics in the context of CMS’ withdrawal of the liability MSA NPRM, this Part 4 article also asks: 1) how should the structured settlement market interpret the two almost simultaneous CMS actions (published statistics and NPRM withdrawal); and 2) should the structured market respond? 3) and, if yes, how and why?

WCMSAs: An Unquantified Structured Settlement Submarket

At least since the financial crisis of 2007-2009, WCMSAs have represented a significant structured settlement submarket as the result of two primary factors.

First, in calculating present value, CMS insists that a WCMSA does not need to be indexed for inflation and may not be discounted to present-day value.

CMS originally communicated this present value methodology in a WCMSA Memorandum published October 15, 2004. Although the Memorandum has since been removed from the CMS website, CMS apparently continues to follow this methodology.

For structured settlement annuities, this CMS present value methodology provides an inherent cost advantage versus lump sum because annuities incorporate their own discount rate. Primarily because of this cost advantage, some industry experts estimate defendants save as much as 30 percent per case on average by funding WCMSAs with annuities compared with lump sum funding.

Second, as interest rates continued to drop following the 2008 financial crisis, the financial leverage of structured settlements compared to lump sums in non-WCMSA cases diminished and overall structured settlement production thru 2021 failed to regain its earlier growth momentum.

Here is a look at how historic thirty-year Treasury bond yields (as of January each year) have matched up with annual structured settlement annuity production from 2007 thru 2021.

- 2021: $4.23 billion (1.66%)

- 2020: $4.92 billion (2.33%)

- 2019: $6.46 billion (2.97%)

- 2018: $6.02 billion (2.81%)

- 2017: $5.55 billion (3.04%)

- 2016: $5.80 billion (2.98%)

- 2015: $5.35 billion (2.69%)

- 2014: $5.25 billion (3.92%)

- 2013: $5.13 billion (3.04%)

- 2012: $4.82 billion (2.98%)

- 2011: $4.97 billion (4.39%)

- 2010: $5.52 billion (4.65%)

- 2009: $5.38 billion (2.83%)

- 2008: $6.23 billion (4.35%)

- 2007: $6.0 billion (4.79%)

During the 12-year time period from 2009-2021, as overall structured settlement annuity sales languished, industry leaders proposed various strategies, including “growth initiatives” and “innovation committees,” attempting to revitalise lacklustre premium production – with, at best, intermittent success.

What the structured settlement industry production reports have failed to identify and, therefore, what strategic industry discussions in general have failed to consider, is how much recent structured settlement case activity and annuity premium now result from, and depend upon, WCMSAs.

The two recent CMS actions (published WCMSA statistics and NPRM withdrawal) not only provide government data to help estimate those numbers, but also highlights two critical problems: the MSA structured settlement submarket lacks a definitive legislative and/or regulatory foundation and could disappear “without comment” at any time.

The CMS Fiscal Year WCMSA Statistics Report

The WCMSA Fiscal Year Statistics for 2020-2022 represent, to this writer’s knowledge, the first time CMS has published such statistics.

In analyzing these statistics, note first: the CMS Fiscal Year, which begins October 1 and ends September 30, does not match the structured settlement industry calendar reporting year. The comparable structured settlement numbers begin in the fourth calendar year quarter and end in the third quarter of the following calendar year.

Note also: the reported CMS statistics consist of two tables each for three Fiscal Years:

- Table 1: WCMSA Propose Values (i.e. submissions) and

- Table 2: Workers Compensation Review Contractor (WCRC) Values (i.e. approvals).

For the analysis in this article, we are interested in “approvals” (Table 2) and will focus only on the most recently reported Fiscal Year (2022).

Estimating 2022 Fiscal Year WCMSA Structured Settlements

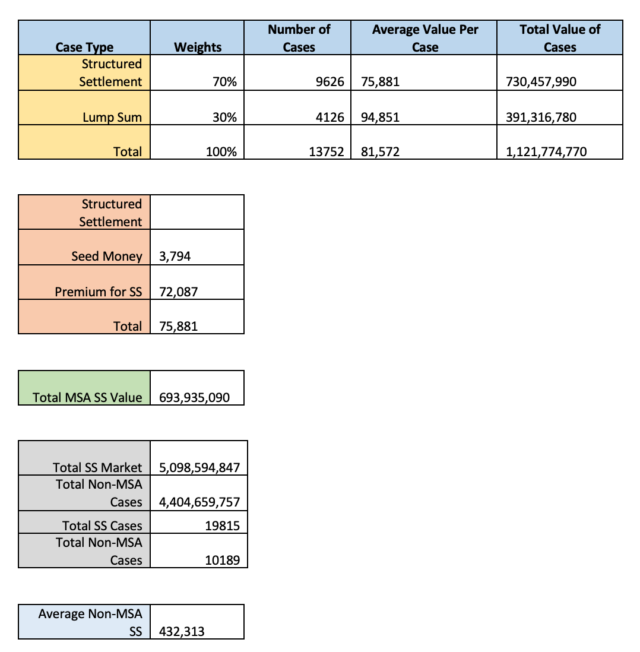

This section estimates how many of the approved Fiscal Year 2022 WCMSAs represent structured settlements and how much structured settlement annuity premium those WCMSAs generated in the context of overall structured settlement industry results for the same time period (2021 4th Quarter thru 2022 3rd Quarter).

- Table 2 Numbers – The most relevant CMS WCMSA Table 2 reported numbers are:

- Total WCRC Recommendations Completed (13,752) and

- Total WCRC Recommended WCMSA Average ($81,571.75).

- Assumptions – We also require three assumptions. Readers are encouraged to perform their own calculations using assumptions based on their own knowledge and experience. One of the industry’s leading structured settlement MSA experts, possessing substantial first hand WCMSA knowledge, provided the following assumptions to Independent Life:

- Average Cost Savings – Funding a WCMSA with an annuity versus a lump sum saves a defendant an average cost of 30 percent.

- WCMSAs Funded with Structured Settlements – As a result, defendants fund 70 percent of WCMSAs (9626 out of 13,752 in FY 2022) with structured settlements.

- Seed Money – Average seed money for an annuity funded WCMSA averages five (5) percent of the WCMSA cost. “Seed money,” in a structured WCMSA, represents an initial deposit required to cover the first surgery or procedure for each body part, and/or replacement and the first two years of annual payments.

- Calculations

- Estimated 2022 Fiscal Year Results

- All Structured Settlement Cases

- Total Premium: $5,098,594,847

- Total Cases: 19,815

- Average Case Size: $257,209

- WCMSA Cases

- Total Premium: $693,935,090

- Total Cases: 9626

- Average Case Size: $72,087

- Non-WCMSA Cases

- Total Premium: $4,404,659,757

- Total Cases: 10,189

- Average Case Size: $432,313

- All Structured Settlement Cases

Observations and Analysis

- Based on the CMS published statistics and one industry expert’s assumptions, 49 percent of the total number of structured settlement cases completed during Fiscal Year 2022 were WCMSAs. Given the inherent cost advantage CMS has provided to structured settlement funded WCMSAs, it is possible that percentage is actually conservative and may even increase going forward.

- Combined industry reporting of WCMSA and non-WCMSA structured settlement cases not only hides the significance of the WCMSA submarket, it obscures other strategic issues and trends:

- The disparity in average size between the average WCMSA and non-WCMSA structured settlement cases.

- The degree by which non-WCMSA annual structured settlement industry premium has declined since 2001 (the same year CMS published the Patel Memorandum) – especially non-WCMSA premium proactively generated by defendants.

- To repeat, unlike the tax exclusions in IRC 104 (a)(1) and 2), no legislative or regulatory authority exists supporting the inherent cost advantage CMS heretofore has provided structured settlement funded WCMSAs compared with lump sums.

- Despite adhering to the present value methodology that generates an inherent cost advantage for structured settlement funded WCMSAs, CMS has previously “consolidated and supplanted” the October 15, 2004 WCMSA Memorandum that defined that cost advantage.

- For these reasons, when CMS withdrew the proposed Notice of Proposed Rulemaking (NPRM) on October 13, 2022, the result potentially represented a double loss to the structured settlement market.

- The NPRM, discussed in this prior article – would have clarified “existing Medicare Secondary Payer (MSP) obligations associated with future medical items related to liability insurance (including self-insurance), no fault insurance, and workers’ compensation settlements, judgments, awards, or other payments.”

- For structured settlements, the proposed NPRM might have permanently defined an inherent funding advantage not only for WCMSAs but also for liability MSAs, a market many industry experts believe could be at least as large as the WCMSA market.

- The NPRM withdrawal surprised most MSP experts – and presumably also the National Structured Settlement Trade Association (NSSTA).

- Beginning in 2021, however, NSSTA and the National MSP Network (MSPN) had already formed a “Structured Settlement MSA Working Group” to promote the very issues needed to maintain and extend structured settlement MSA funding advantages. The American Association of Settlement Consultants (AASC) had likewise engaged with MSPN.

- To a limited degree, therefore, NSSTA, AASC and MSPN had each recognized and acknowledged structured settlement funding of MSAs as a lobbying priority before the recent CMS actions (published WCMSA statistics and NPRM withdrawal). Each association had also offered its members frequent educational programs about the linkage between structured settlements and WCMSAs.

- What has been missing within the structured settlement industry, as it relates to MSAs, has been political cooperation between NSSTA and AASC as well as improved strategic analysis about how to grow the structured settlement market that considers the current impact, as well as the opportunities and risks, of MSAs.

Conclusion

Structured settlements offer multiple benefits for all MSA stakeholders including Medicare and Medicare beneficiaries. Whether or not intentional, CMS has provided structured settlements with a critical cost advantage compared with lump sums that has helped to expand the application of structured settlements for WCMSA cases.

The two recent CMS actions (published WCMSA statistics and NPRM withdrawal) should serve as a wake-up call for all MSA professional stakeholders who utilize structured settlements. Despite the past success of structured settlements in the WCMSA submarket, a more permanent legislative or regulatory foundation is needed.

The demonstrated success of structured settlement WCMSA funding justifies making this cost advantage permanent and expanding this cost advantage to liability MSAs whenever applicable liability MSA regulatory rules are promulgated.

This article concludes Independent Life’s 4-part MSA series.